We’ve all been there: staring at a pile of bills, feeling the knot in our stomach tighten as we wonder how we’re going to pay them all. Financial stress can often feel like an insurmountable mountain, a constant source of anxiety that impacts our daily lives. But what if I told you there’s a tool that can help you regain control of your finances? Enter the budgeting spreadsheet, a simple yet powerful tool to alleviate financial anxiety.

Understanding Financial Anxiety

Financial anxiety is more than just worrying about paying bills. It’s a form of distress that can lead to sleepless nights, feelings of guilt, and even depression. Often caused by heavy debt, unexpected expenses, or a lack of savings, financial anxiety can feel like a dark cloud hanging over your head. But it’s important to tackle it head-on, not just for your wallet, but for your overall well-being too.

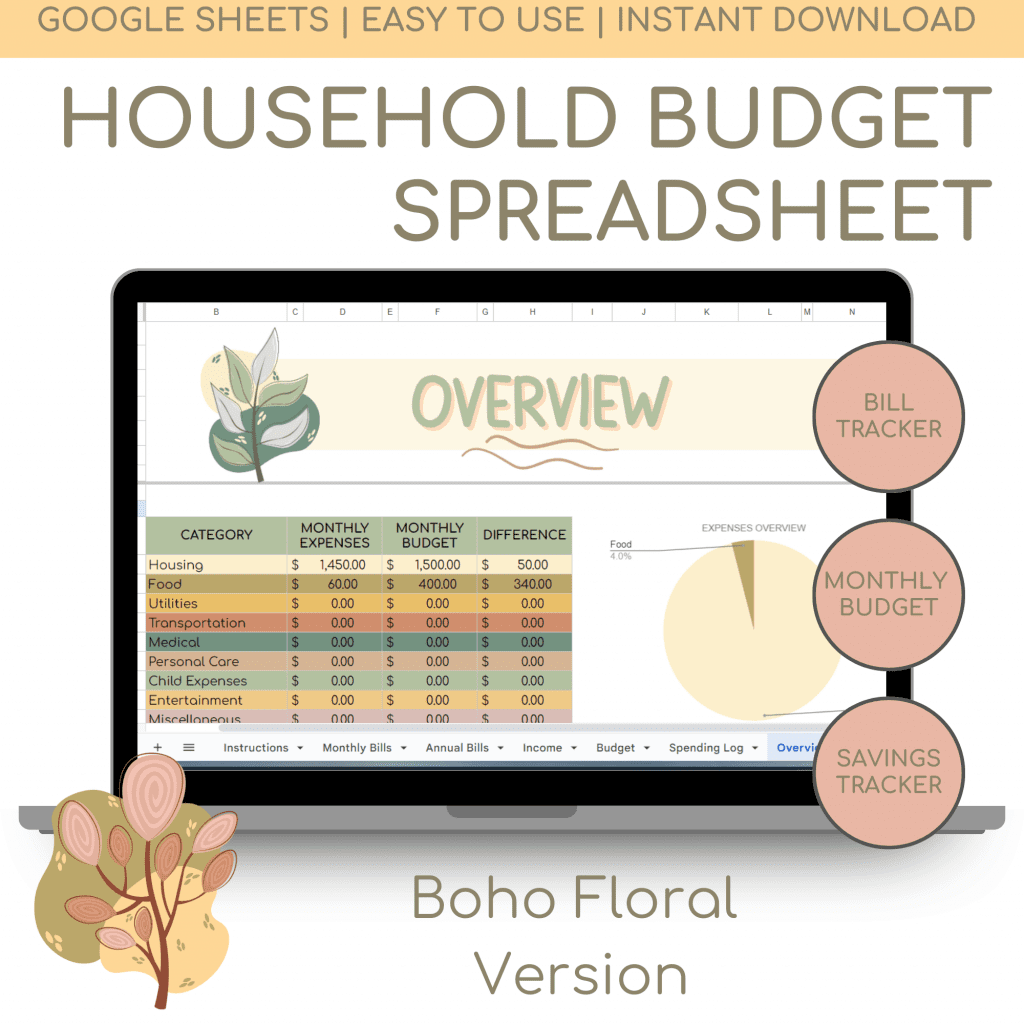

Enter the Budgeting Spreadsheet

The beauty of a budgeting spreadsheet lies in its simplicity. It’s an organizational powerhouse, allowing you to track your income, expenses, and bills all in one place. But it doesn’t stop there. A budgeting spreadsheet also:

- GAIN CLARITY ON CURRENT SPENDING HABITS: a spreadsheet can provide a clear understanding of where your money is going, making it easy to identify areas where you can cut back and save.

- CREATE A REALISTIC BUDGET: Based on your income and expenses, a spreadsheet can help you create a budget that is achievable and realistic, allowing you to live within your means and avoid overspending.

- REDUCE FINANCIAL STRESS: With a clear view of your finances and a realistic budget in place, you’ll feel more in control of your money and less stressed about your financial situation.

- STAY ACCOUNTABLE: a spreadsheet can help you stay accountable to your budget by tracking your spending and alerting you when you are approaching or exceeding your budget limits.

- AVOID LATE FEES: tracking your bills and due dates on a spreadsheet can help you avoid late payments and the associated fees.

- SAVE MONEY: identifying areas where you can cut back on spending can help you save money and build a strong financial foundation.

- ACHIEVE FINANCIAL FREEDOM: With a clear understanding of your finances, a realistic budget, and a system in place to track your progress, you’ll be on your way to achieving financial freedom and the peace of mind that comes with it.

Why A Budget Spreadsheet You Ask?

Simplified Design

A clean, uncluttered spreadsheet layout is so important for not feeling anxious when dealing with your finances. A cluttered spreadsheet can be as overwhelming as a cluttered room. Use of colors, fonts, and formatting can enhance readability and reduce distractions. But can also be beautiful at the same time.

Customizable Templates

A budgeting spreadsheet template can be customized to suit individual preferences, making them an invaluable tool to fit just your needs. Plus, if you get a pre-designed spreadsheet most of the heavy lifting of creating is done for you with added automatic calculations and formulas.

Tips for Overcoming Financial Anxiety with a Budgeting Spreadsheet

- Using a budgeting spreadsheet is only half the battle. It’s important to regularly review your budget to stay on track with your financial goals.

- Be patient with yourself and set realistic expectations. Remember, Rome wasn’t built in a day, and neither is financial stability.

- If you’re feeling overwhelmed, don’t hesitate to seek support from friends, family, or professional resources. You’re not alone on this journey.

- While I LOVE spreadsheets and use them for just about everything, the most important thing is that you find a system that you can work and works well for you.

In conclusion, financial anxiety can be daunting, but it’s not insurmountable. A budgeting spreadsheet can be a game-changer, helping you organize your finances, understand your spending habits, and set achievable financial goals. So why wait? Take control of your financial future today with a budgeting spreadsheet. You’ve got this!

FREE To-Do List Spreadsheet

Reclaim your time and gain control of your daily tasks and long-term goals with this FREE customizable To-Do list!

Other

Posts You Might Like

Complete Budget Spreadsheet